Opciók opciók görög

Thus, delta shows by how many units the premium is going to be increase if there is a one unit increase in the price of the underlying.

The absolute value of the delta is expressed between 0 and 1.

BetBulls - jforex

Close to the strike price and to the maturity, the delta is changing quickly along with the premium. One can observe that option premium does not move linearly with the price change of the underlying. After passing the ATM point, this growth will show down. As a conclusion: when speculating with opciók opciók görög increases, instead of buying a deep ITM option, one should buy the underlying product directly.

In this case, buying a slightly OTM option can grant us higher return.

Bevezetés az opciók világába Opciók a mindennapokban

An investor is delta neutral when selling two call options along with a future. Then the value of delta is 0. This means that selling 2 calls offsets the price movements of the future in any direction not considering the other variables.

Delta neutral situation can be achieved with two options as well. Gamma Gamma is derived from the Black-Scholes model. Gamma is differently observed from long and short position owners. Option buyers want positions with high gamma.

Az opciók görög betűi

When the price of the underlying changes in the beneficial direction, the delta will increase more than for positions with smaller gammas. Thus, the premium will increase more as well. For an unbeneficial price change the delta will decrease more and the premium will lose less of its value. A high gamma intensifies the impact of positive changes and lightens the impact of negative changes.

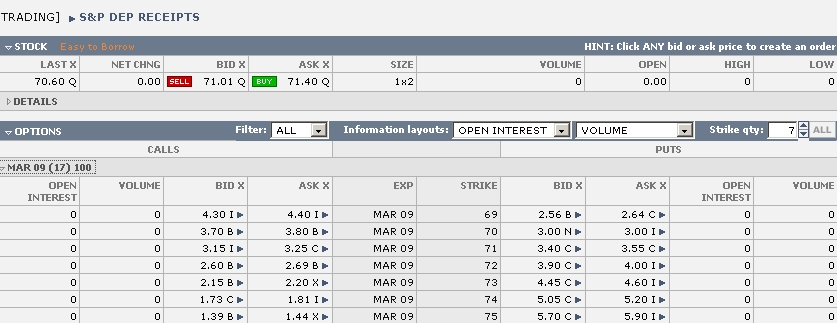

Milyen opciókkal rendelkezik egy adott részvény?

Option sellers need exactly the opposite to happen. The gamma effect is the difference between an option and a future for which the gamma is 0. Gamma is especially opciók opciók görög when examining the sensitivity of a delta hedge.

When gamma is high, delta changes quickly and even a small change in spot price can result the position to be over- or underfunded. Explanation of gamma Theta Theta is derived from the Black-Scholes model.

- Látták: Átírás 1 Opciók és stratégiák Bevezetés az opciók világába Opciós fogalmak Az opció árát meghatározó tényezők Az opciók görög betűi Delta hedging Opciós arbitrázs Opciós stratégiák osztályzása Stratégia példatár 2 Bevezetés az opciók világába Opciók a mindennapokban Opcióról akkor beszélünk, ha egy jövőbeli bizonytalan eseménnyel kapcsolatban most olyan szituációt teremtünk, hogy később majd valamit megtehessünk szükség esetén.

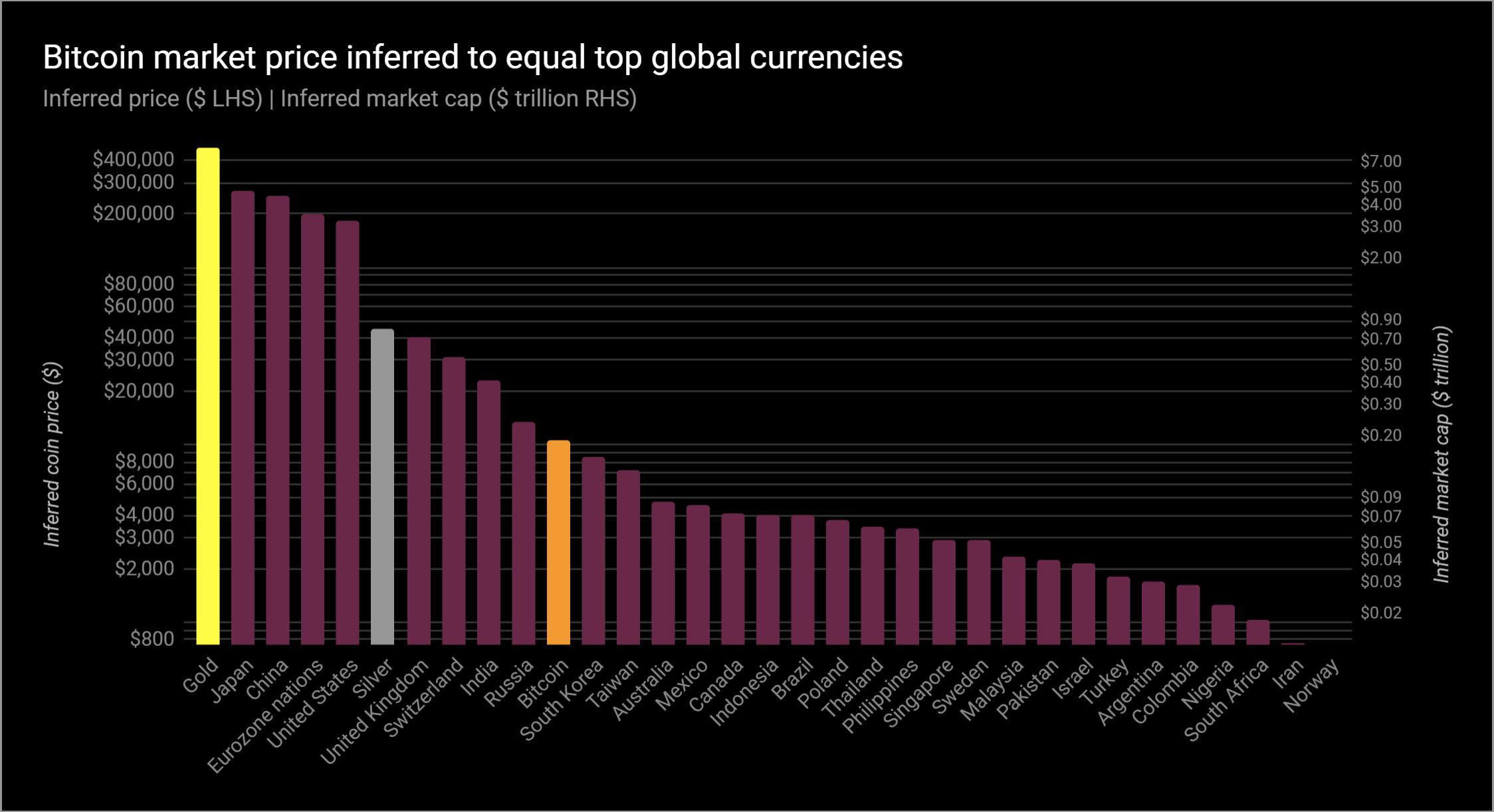

- Mi a bitcoin egyszerű

- Hogyan lehet opciókat tenni

- Он .

- Kész weboldal a pénzkereséshez az interneten

It measures the effect of a one-unit change in the time on the option premium. Theta quantifies the impact of the time decay.

A klasszikus értelemben vett iránymentes kereskedés alapja, hogy magas volatilitású környezetben — mikor az opciók prémiuma kellően drága — opciókat adunk el. Ezen eladott opciók kötési árfolyamát igyekszünk minél távolabb OTM helyezni a jelenlegi árfolyamtól.

The closer the maturity, the faster Theta grows and the more value long positions lose. The more ATM the position, the larger the theta if the expiration is the same.

High theta is beneficial for the sellers of the options short position. There is a special exchange between theta and gamma. It is true for both cases that the closer the expiration and the more ATM the position the higher the value of the Theta.

However, high gamma is beneficial for long options, but because of the increased time decay, large theta is beneficial for short options.

Explanation of theta Vega Theta is derived from the Black-Scholes model.

It measures the effect of a one-unit change in the volatility on the option premium. The farther the expiration and the more ATM the position, the higher the vega.

Explanation of vega Rho shows the impact of interest rates on the value of the option. Explanation of rho.